Multiple Choice

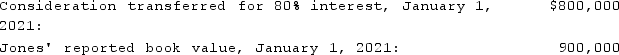

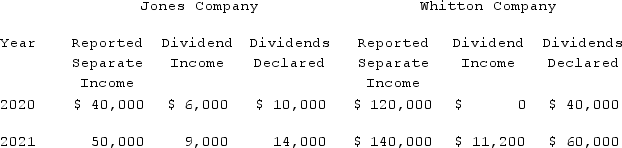

On January 1, 2020, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2021, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:  Compute the net income attributable to the noncontrolling interest for 2021.

Compute the net income attributable to the noncontrolling interest for 2021.

A) $11,000.

B) $10,800.

C) $9,000.

D) $8,200.

E) $7,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: Paris, Inc. owns 80% of the voting

Q94: Hardford Corp. held 80% of Inglestone Inc.,

Q95: Woods Company has one depreciable asset valued

Q96: Florrick Co. owns 85% of Bishop Inc.

Q97: T Corp. owns several subsidiaries that are

Q99: The benefits of filing a consolidated tax

Q100: Buckette Co. owned 60% of Shuvelle Corp.

Q101: Kurton Inc. owned 90% of Luvyn Corp.'s

Q102: Dean, Inc. owns 90% of Ralph, Inc.

Q103: Jull Corp. owned 80% of Solaver Co.