Multiple Choice

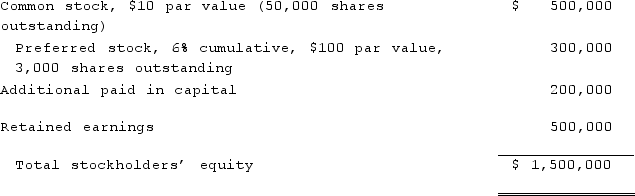

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the goodwill recognized in consolidation.

Compute the goodwill recognized in consolidation.

A) $800,000.

B) $310,000.

C) $124,000.

D) $0.

E) $(196,000) .

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following statements is false

Q37: On January 1, 2021, Rhodes Co. owned

Q38: If a subsidiary issues a stock dividend,

Q39: What are the primary sources of information

Q40: If a subsidiary re-acquires its outstanding shares

Q42: How do outstanding subsidiary stock warrants affect

Q43: Wolff corporation owns 70% of the outstanding

Q44: Where do dividends paid to the noncontrolling

Q45: Which of the following characteristics is not

Q46: What condition(s) qualify an entity as a