Multiple Choice

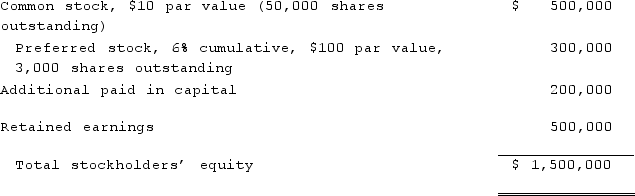

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  The consolidation entry at date of acquisition will include (referring to Smith) :

The consolidation entry at date of acquisition will include (referring to Smith) :

A) Debit Common stock $500,000 and debit Preferred stock $120,000.

B) Debit Common stock $400,000 and debit Additional paid-in capital $160,000.

C) Debit Common stock $500,000 and debit Preferred stock $300,000.

D) Debit Common stock $500,000, debit Preferred stock $120,000, and debit Additional paid-in capital $200,000.

E) Debit Common stock $400,000, debit Preferred stock $300,000, debit Additional paid-in capital $200,000, and debit Retained earnings $500,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q98: How are intra-entity inventory transfers treated on

Q99: A subsidiary issues new shares of common

Q100: A parent company owns a 70% interest

Q101: How would consolidated earnings per share be

Q102: Ryan Company purchased 80% of Chase Company

Q104: Knight Co. owned 80% of the common

Q105: Gordon Co. reported current earnings of $580,000

Q106: Jet Corp. acquired all of the outstanding

Q107: All of the following are examples of

Q108: In reporting consolidated earnings per share when