Multiple Choice

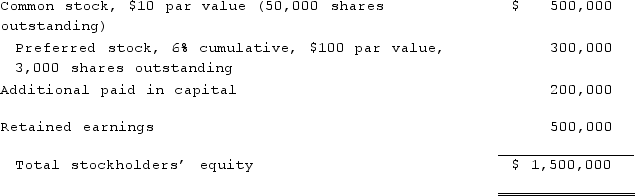

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  If Smith's net income is $100,000 in the year following the acquisition,

If Smith's net income is $100,000 in the year following the acquisition,

A) The portion allocated to the common stock (residual amount) is $92,800.

B) $10,800 preferred stock dividend will be subtracted from net income attributed to common stock in arriving at noncontrolling interest in consolidated income.

C) The noncontrolling interest in consolidated net income is $27,200.

D) The preferred stock dividend will be ignored in noncontrolling interest in consolidated net income because Nichols owns the noncontrolling interest of preferred stock.

E) The noncontrolling interest in consolidated net income is $30,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: MacDonald, Inc. owns 80% of the outstanding

Q83: When a company has preferred stock in

Q84: A variable interest entity can take all

Q85: Thomas Inc. had the following stockholders' equity

Q86: Which one of the following characteristics of

Q88: The following information has been taken from

Q89: Skipen Corp. had the following stockholders' equity

Q90: Jacoby Co. owned a controlling interest in

Q91: Which of the following is not a

Q92: Parent Corporation acquired some of its subsidiary's