Essay

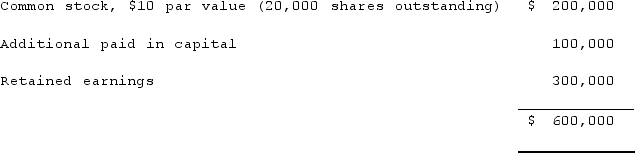

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

The investment accou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Ryan Company purchased 80% of Chase Company

Q30: If new bonds are issued from a

Q31: Popper Co. acquired 80% of the common

Q32: On January 1, 2021, Nichols Company acquired

Q33: Fargus Corporation owned 51% of the voting

Q35: How does the existence of a noncontrolling

Q36: Which of the following statements is false

Q37: On January 1, 2021, Rhodes Co. owned

Q38: If a subsidiary issues a stock dividend,

Q39: What are the primary sources of information