Essay

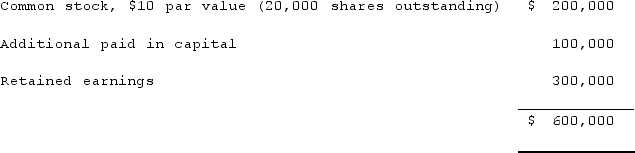

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Prepare Panton's journal entry to recognize the impact of this transaction.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Prepare Panton's journal entry to recognize the impact of this transaction.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A subsidiary issues new shares of common

Q2: The following information has been taken from

Q3: What would differ between a statement of

Q5: A parent company owns a controlling interest

Q6: Parent Corporation acquired some of its subsidiary's

Q7: Webb Company purchased 90% of Jones Company

Q8: Key Company has had bonds payable of

Q9: On January 1, 2021, Nichols Company acquired

Q10: A parent acquires all of a subsidiary's

Q11: Ryan Company purchased 80% of Chase Company