Multiple Choice

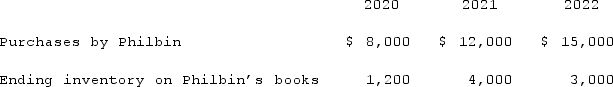

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

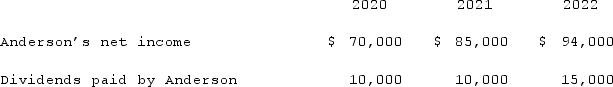

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

A) $8,500.

B) $8,570.

C) $8,430.

D) $8,400.

E) $7,580.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Strickland Company sells inventory to its parent,

Q37: Charleston Inc. acquired 75% of Savannah Manufacturing

Q38: Pepe, Incorporated acquired 60% of Devin Company

Q39: Several years ago, Polar Inc. acquired an

Q40: Parent sold land to its subsidiary resulting

Q42: Vickers Inc. acquired all of the common

Q43: Stark Company, a 90% owned subsidiary of

Q44: When is the gain on an intra-entity

Q45: On January 1, 2021, Musical Corp. sold

Q46: Stark Company, a 90% owned subsidiary of