Multiple Choice

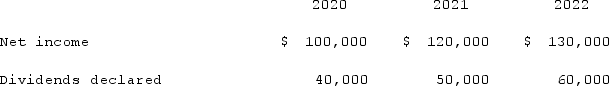

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

A) $19,500.

B) $18,250.

C) $11,750.

D) $38,250.

E) $37,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Brooks Co. acquired 90% of Hill Inc.

Q2: Hambly Corp. owned 80% of the voting

Q3: Anderson Company, a 90% owned subsidiary of

Q4: On January 1, 2021, Pride, Inc. acquired

Q5: Prater Inc. owned 85% of the voting

Q7: Stiller Company, an 80% owned subsidiary of

Q8: Virginia Corp. owned all of the voting

Q9: Lewis Corp. acquired all of the voting

Q10: Yoderly Co., a wholly owned subsidiary of

Q11: Beesly Co. owned all of the voting