Multiple Choice

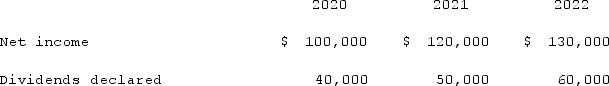

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

A) $1,925.

B) $1,825.

C) $2,000.

D) $1,500.

E) $7,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: An intra-entity transfer of a depreciable asset

Q100: What is the purpose of the adjustments

Q101: Milton Co. owned all of the voting

Q102: Stiller Company, an 80% owned subsidiary of

Q103: Flintstone Inc. acquired all of Rubble Co.

Q105: Anderson Company, a 90% owned subsidiary of

Q106: On January 1, 2021, Daniel Corp. acquired

Q107: How does a gain on an intra-entity

Q108: On January 1, 2021, Pride, Inc. acquired

Q109: Which of the following statements is true