Multiple Choice

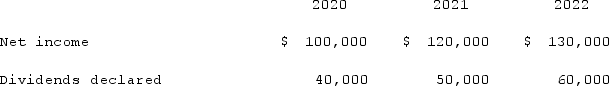

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2020.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2020.

A) $72,000.

B) $90,000.

C) $73,575.

D) $73,800.

E) $72,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: How is the gain on an intra-entity

Q65: Poole Co. acquired 100% of Mullen Inc.

Q66: Anderson Company, a 90% owned subsidiary of

Q67: Anderson Company, a 90% owned subsidiary of

Q68: Stark Company, a 90% owned subsidiary of

Q70: Stiller Company, an 80% owned subsidiary of

Q71: Pepe, Incorporated acquired 60% of Devin Company

Q72: On January 1, 2021, Musical Corp. sold

Q73: On January 1, 2021, Pride, Inc. acquired

Q74: Milton Co. owned all of the voting