Multiple Choice

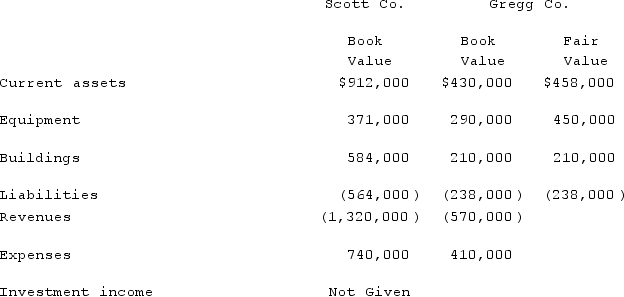

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

A) $48,000 and $262,800.

B) $48,000 and $273,000.

C) $42,900 and $267,900.

D) $42,900 and $262,800.

E) $48,000 and $267,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Pell Company acquires 80% of Demers Company

Q45: How would you determine the amount of

Q46: Daniels Inc. acquired 85% of the outstanding

Q47: Pell Company acquires 80% of Demers Company

Q48: Pennant Corp. owns 70% of the common

Q50: One company buys a controlling interest in

Q51: Pell Company acquires 80% of Demers Company

Q52: On January 1, 2019, Palk Corp. and

Q53: Pell Company acquires 80% of Demers Company

Q54: Scott Co. acquired 70% of Gregg Co.