Multiple Choice

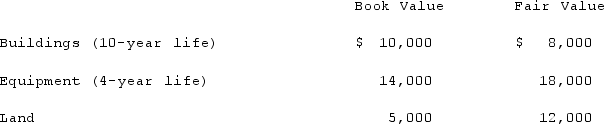

McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Equipment account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Equipment account?

A) $3,000 increase.

B) $3,000 decrease.

C) $2,700 increase.

D) $2,700 decrease.

E) No adjustment is necessary.

Correct Answer:

Verified

Correct Answer:

Verified

Q108: McGuire Company acquired 90 percent of Hogan

Q109: Pell Company acquires 80% of Demers Company

Q110: Pell Company acquires 80% of Demers Company

Q111: When a parent uses the equity method

Q112: Pell Company acquires 80% of Demers Company

Q114: Caldwell Inc. acquired 65% of Club Corp.

Q115: McGuire Company acquired 90 percent of Hogan

Q116: In measuring the noncontrolling interest immediately following

Q117: Dodd Co. acquired 75% of the common

Q118: When a parent company acquires a less-than-100