Multiple Choice

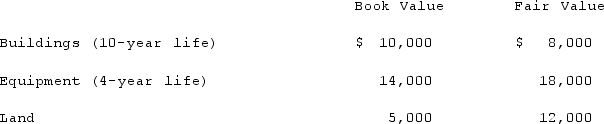

McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Land account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Land account?

A) $7,000 increase.

B) $7,000 decrease.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: When a parent uses the acquisition method

Q68: Brady, Inc., a calendar-year corporation, acquires 85%

Q69: When Valley Co. acquired 80% of the

Q70: Pell Company acquires 80% of Demers Company

Q71: A parent will recognize a gain or

Q73: When control of a subsidiary is acquired

Q74: McGuire Company acquired 90 percent of Hogan

Q75: Parsons Company acquired 90% of Roxy Company

Q76: Which of the following statements is false

Q77: What is pre-acquisition income?