Essay

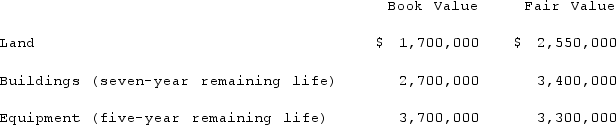

On January 1, 2020, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020.  For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following statements is true

Q3: Scott Co. acquired 70% of Gregg Co.

Q4: All of the following statements regarding the

Q5: Pell Company acquires 80% of Demers Company

Q6: Renz Co. acquired 80% of the voting

Q7: Consolidated net income represents the combined net

Q8: Pell Company acquires 80% of Demers Company

Q9: On January 1, 2018, Vacker Co. acquired

Q10: Pell Company acquires 80% of Demers Company

Q11: Pell Company acquires 80% of Demers Company