Multiple Choice

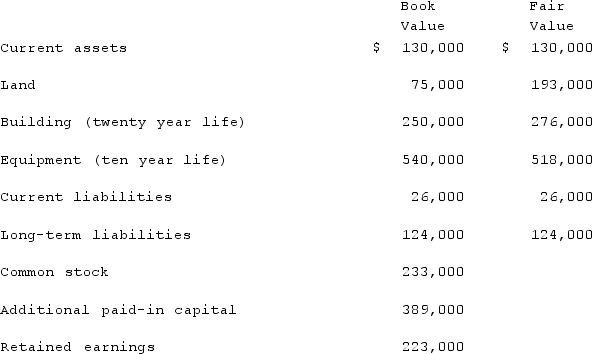

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

A) ($2,200) .

B) ($900) .

C) $(1,300) .

D) $(2,100) .

E) $3,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Carnes Co. decided to use the partial

Q2: Watkins, Inc. acquires all of the outstanding

Q4: Dutch Co. has loaned $90,000 to its

Q5: How is the goodwill impairment process simplified

Q6: Kaye Company acquired 100% of Fiore Company

Q7: Watkins, Inc. acquires all of the outstanding

Q8: Private companies, with respect to goodwill:<br>A) May

Q9: Harrison, Inc. acquires 100% of the voting

Q10: Which of the following is not an

Q11: Beatty, Inc. acquires 100% of the voting