Multiple Choice

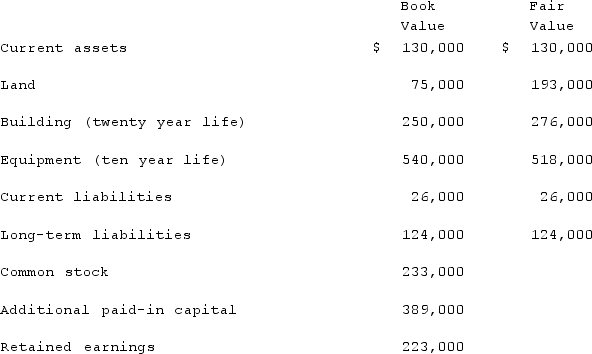

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?

A) $83,000.

B) $133,100.

C) $134,000.

D) $134,900.

E) $185,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Beatty, Inc. acquires 100% of the voting

Q101: Craft Corp. acquired all of the common

Q102: All of the following are acceptable methods

Q103: On January 1, 2020, Barber Corp. paid

Q104: Following are selected accounts for Green Corporation

Q106: Compare the differences in accounting treatment for

Q107: Following are selected accounts for Green Corporation

Q108: On January 1, 2020, Barber Corp. paid

Q109: Kaye Company acquired 100% of Fiore Company

Q110: Anderson, Inc. acquires all of the voting