Multiple Choice

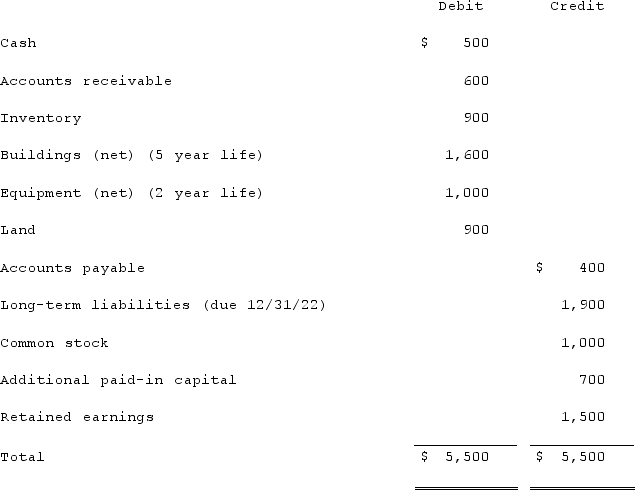

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

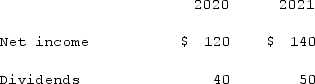

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

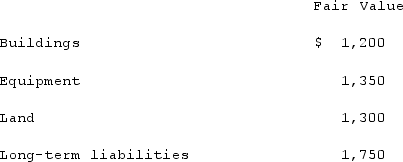

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.

A) $0.

B) $1,000.

C) $1,175.

D) $1,350.

E) $1,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q108: On January 1, 2020, Barber Corp. paid

Q109: Kaye Company acquired 100% of Fiore Company

Q110: Anderson, Inc. acquires all of the voting

Q111: Jackson Company acquires 100% of the stock

Q112: Vaughn Inc. acquired all of the outstanding

Q114: On January 1, 2019, Rand Corp. issued

Q115: Harrison, Inc. acquires 100% of the voting

Q116: On January 1, 2020, Barber Corp. paid

Q117: Pritchett Company recently acquired three businesses, recognizing

Q118: With respect to the recognition of goodwill