Multiple Choice

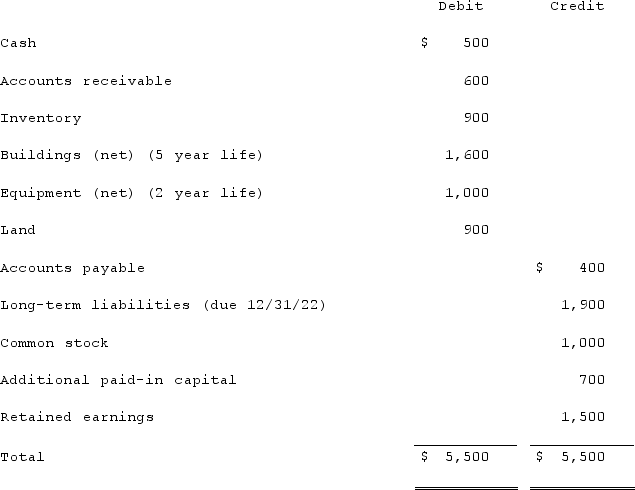

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

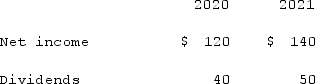

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

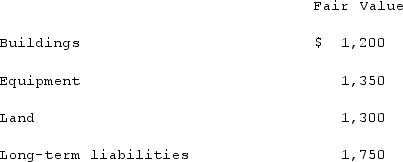

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.

A) $1,750.

B) $1,800.

C) $1,850.

D) $1,900.

E) $2,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q89: A business combination results in $90,000 of

Q90: Following are selected accounts for Green Corporation

Q91: Following are selected accounts for Green Corporation

Q92: Which of the following is false regarding

Q93: Prince Company acquires Duchess, Inc. on January

Q95: Jaynes Inc. acquired all of Aaron Co.'s

Q96: Under the initial value method, the parent

Q97: Anderson, Inc. acquires all of the voting

Q98: Black Co. acquired 100% of Blue, Inc.

Q99: Kaye Company acquired 100% of Fiore Company