Multiple Choice

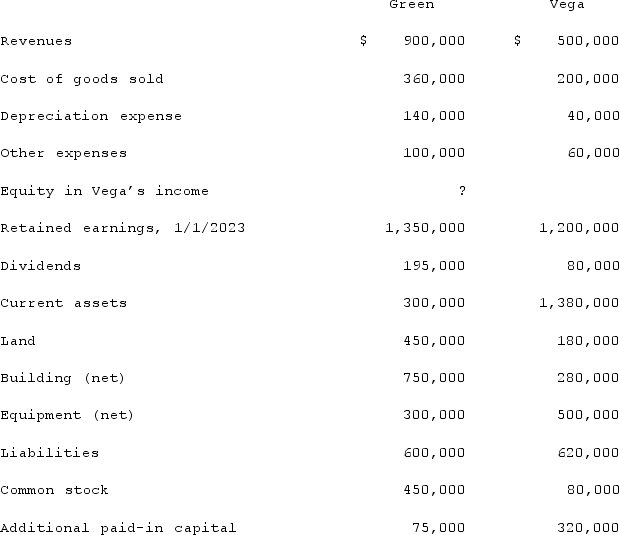

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

A) $620,000.

B) $280,000.

C) $900,000.

D) $909,625.

E) $299,625.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Which one of the following varies between

Q66: Consolidated net income using the equity method

Q67: When consolidating parent and subsidiary financial statements,

Q68: Following are selected accounts for Green Corporation

Q69: With respect to identifiable intangible assets other

Q71: Under the partial equity method, the parent

Q72: Jackson Company acquires 100% of the stock

Q73: Which of the following will result in

Q74: Harrison, Inc. acquires 100% of the voting

Q75: An impairment model is used<br>A) To assess