Multiple Choice

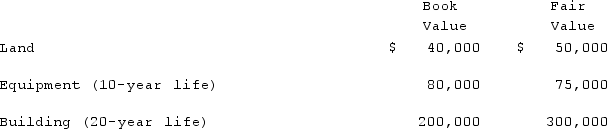

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

A) $(5,000) .

B) $80,000.

C) $75,000.

D) $73,500.

E) $(3,500) .

Correct Answer:

Verified

Correct Answer:

Verified

Q80: When a company applies the initial value

Q81: Matthews Co. acquired all of the common

Q82: Anderson, Inc. acquires all of the voting

Q83: What is the partial equity method? How

Q84: Under the equity method of accounting for

Q86: Reeder Corp. acquired one hundred percent of

Q87: When consolidating a subsidiary under the equity

Q88: According to the FASB ASC regarding the

Q89: A business combination results in $90,000 of

Q90: Following are selected accounts for Green Corporation