Multiple Choice

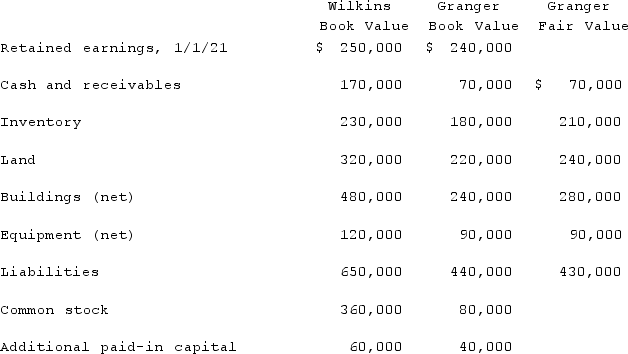

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

A) $0.

B) $20,000.

C) $40,000.

D) $42,000.

E) $82,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: The financial statements for Jode Inc. and

Q47: Which of the following statements is true

Q48: The financial statement amounts for the Atwood

Q49: The financial statement amounts for the Atwood

Q50: What is the primary difference between: (i)

Q52: How are direct combination costs accounted for

Q53: Using the acquisition method for a business

Q54: The financial statements for Jode Inc. and

Q55: The financial statement amounts for the Atwood

Q56: With respect to recognizing and measuring the