Multiple Choice

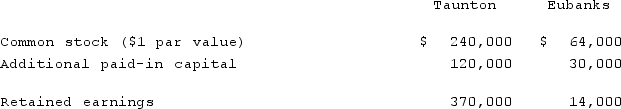

Prior to being united in a business combination, Taunton Inc. and Eubanks Corp. had the following stockholders' equity figures:  Taunton issued 62,000 new shares of its common stock valued at $2.75 per share for all of the outstanding stock of Eubanks.Assume that Taunton acquired Eubanks on January 1, 2020 and that Eubanks maintains a separate corporate existence. At what amount did Taunton record the investment in Eubanks?

Taunton issued 62,000 new shares of its common stock valued at $2.75 per share for all of the outstanding stock of Eubanks.Assume that Taunton acquired Eubanks on January 1, 2020 and that Eubanks maintains a separate corporate existence. At what amount did Taunton record the investment in Eubanks?

A) $62,000.

B) $108,000.

C) $170,500.

D) $201,500.

E) $234,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Lisa Co. paid cash for all of

Q34: In an acquisition where 100% control is

Q35: What is the purpose of Consolidation Entry

Q36: The financial statements for Campbell, Inc., and

Q37: The financial statement amounts for the Atwood

Q39: Which of the following statements is true

Q40: Contingent consideration.<br>A)Increase Investment account.<br>B)Decrease Investment account.<br>C)Increase Liabilities.<br>D)Increase

Q41: The financial statements for Jode Inc. and

Q42: Bargain purchase.<br>A)Increase Investment account.<br>B)Decrease Investment account.<br>C)Increase Liabilities.<br>D)Increase

Q43: Flynn acquires 100 percent of the outstanding