Multiple Choice

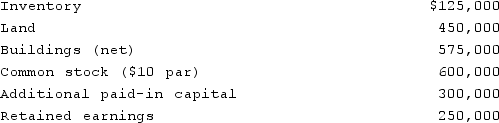

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.On December 31, 2020, assuming that McCoy will retain its separate corporate existence, what value is assigned to Ferguson's investment account?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.On December 31, 2020, assuming that McCoy will retain its separate corporate existence, what value is assigned to Ferguson's investment account?

A) $150,000.

B) $300,000.

C) $600,000.

D) $900,000.

E) $912,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The financial statement amounts for the Atwood

Q25: The financial statements for Campbell, Inc., and

Q26: On January 1, 2021, Chester Inc. acquired

Q27: According to GAAP, which of the following

Q28: Flynn acquires 100 percent of the outstanding

Q30: Presented below are the financial balances for

Q31: In a transaction accounted for using the

Q32: On January 1, 2021, the Moody Company

Q33: Lisa Co. paid cash for all of

Q34: In an acquisition where 100% control is