Multiple Choice

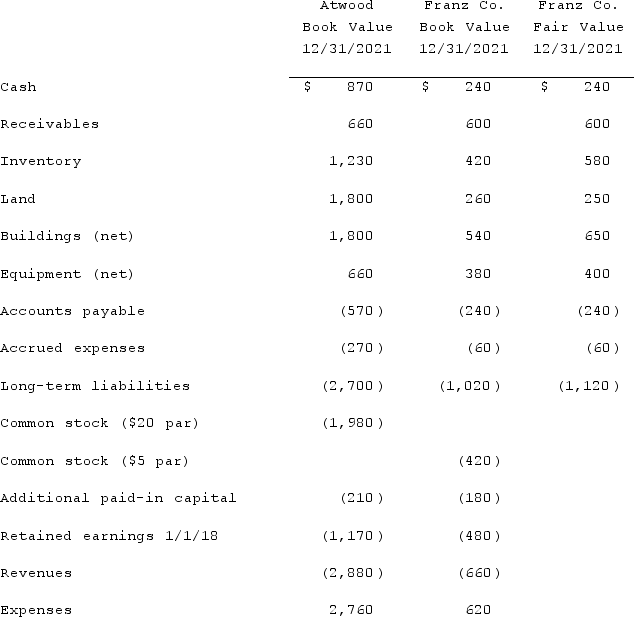

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated equipment (net) at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated equipment (net) at the date of the acquisition.

A) $400.

B) $660.

C) $1,060.

D) $1,040.

E) $1,050.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: The financial statements for Jode Inc. and

Q55: The financial statement amounts for the Atwood

Q56: With respect to recognizing and measuring the

Q57: What are the benefits of using pushdown

Q58: The financial statements for Campbell, Inc., and

Q60: The following are preliminary financial statements for

Q61: Flynn acquires 100 percent of the outstanding

Q62: The financial statement amounts for the Atwood

Q63: The financial statements for Campbell, Inc., and

Q64: Presented below are the financial balances for