Multiple Choice

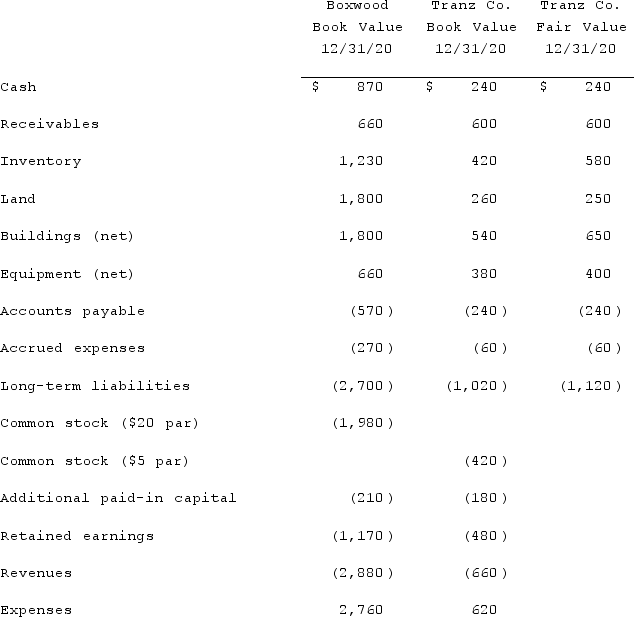

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated retained earnings as a result of this acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated retained earnings as a result of this acquisition.

A) $1,160.

B) $1,170.

C) $1,265.

D) $1,280.

E) $1,650.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: Peterman Co. owns 55% of Samson Co.

Q100: What is the purpose of Consolidation Entry

Q101: On January 1, 2021, the Moody Company

Q102: McCoy has the following account balances as

Q103: Flynn acquires 100 percent of the outstanding

Q105: The financial statements for Campbell, Inc., and

Q106: Elon Corp. obtained all of the common

Q107: How should direct combination costs and amounts

Q108: Acquired in-process research and development is considered

Q109: Presented below are the financial balances for