Essay

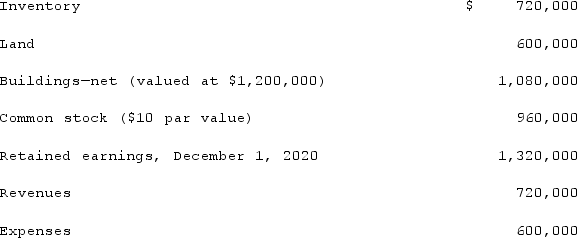

Salem Co. had the following account balances as of December 1, 2020:  Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Correct Answer:

Verified

Correct Answer:

Verified

Q107: How should direct combination costs and amounts

Q108: Acquired in-process research and development is considered

Q109: Presented below are the financial balances for

Q110: Which of the following statements is true

Q111: For acquisition accounting, why are assets and

Q113: Crown Company had common stock of $360,000

Q114: How are direct and indirect costs accounted

Q115: On January 1, 2021, the Moody Company

Q116: Fine Co. issued its common stock in

Q117: Which of the following statements is true