Multiple Choice

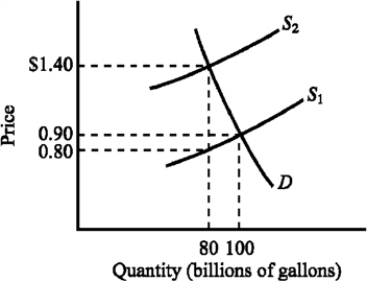

Use the figure below to answer the following question(s) .

Figure 4-7

-Refer to Figure 4-7. The supply curve S1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S1 to S2. Imposing the tax causes the equilibrium price of gasoline to increase from

A) $.80 to $1.40.

B) $.80 to $1.50.

C) $.90 to $1.50.

D) $.90 to $1.40.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: A progressive tax<br>A) is one that taxes

Q83: Suppose the market equilibrium price of wheat

Q84: Which of the following generalizations about the

Q85: Use the figure below to answer the

Q86: Use the figure below to answer the

Q88: If the government wants to raise tax

Q89: Use the figure below to answer the

Q90: Data from the effects of the substantial

Q91: According to the Laffer curve,<br>A) an increase

Q92: A payment the government makes to either