Multiple Choice

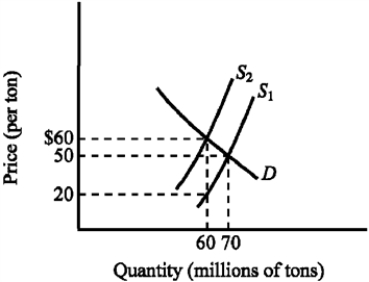

Use the figure below to answer the following question(s) .

Figure 4-8

-Refer to Figure 4-8. Which of the following is true?

A) The tax increases the price of soft coal by $40 per ton.

B) Since the demand for soft coal is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for soft coal is more elastic than the supply, suppliers of soft coal bear most of the burden of the tax.

D) Since the supply of soft coal is highly inelastic, the primary burden of the tax is imposed on the consumers of soft coal.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: After the ban on the production and

Q2: A subsidy on a product will generate

Q3: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q4: Use the figure below to answer the

Q6: When a price floor is imposed above

Q7: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-20

Q8: The Laffer curve illustrates the concept that<br>A)

Q9: Other things constant, if a labor union

Q10: The deadweight loss (or excess burden) resulting

Q11: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18