Multiple Choice

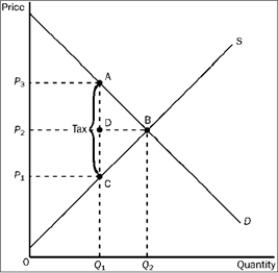

Figure 4-24

-Refer to Figure 4-24. The per unit burden of the tax on buyers is

A) P3 − P1.

B) P3 − P2.

C) P2 − P1.

D) Q2 − Q1.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q185: When a government subsidy is granted to

Q186: Ava states, "If raising the minimum wage

Q187: When a shortage of a good is

Q188: The presence of price controls in a

Q189: An effective minimum wage<br>A) imposes a price

Q191: Figure 4-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-14

Q192: If Aisha were to get a $3,000

Q193: An income tax is progressive if the<br>A)

Q194: A market that operates outside the legal

Q195: An income tax is proportional if<br>A) the