Essay

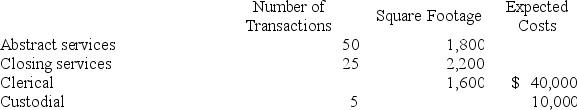

Jack Donaldson owns and operates Jack's Abstracting Service. Jack's two revenue generating operations (Abstracting Services and Closing Services) are supported by two service departments: Clerical and Custodial. Costs in the service departments are allocated in the following order using the designated allocation bases.

Clerical: number of transactions processed.

Custodial: square footage of space occupied.

Average and expected activity levels for next month are as follows:

Required:

Use the reciprocal method to allocate the service department costs to the revenue generating departments. Provide the total costs for the revenue departments.

Correct Answer:

Verified

Abstract: $31,364; Closing: $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Which of the following would be an

Q49: Bonanza Co. manufactures products X and

Q50: The following is a system of

Q51: Which of the following best describes the

Q52: The method of accounting for joint product

Q54: Joint products and by-products are produced simultaneously

Q55: The Mallak Company produced three joint

Q56: Palace Company has two service departments

Q57: The Hsu Manufacturing Company has two

Q58: Which of the following methods provides no