Essay

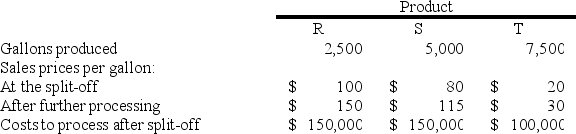

Simpson Manufacturing Enterprises uses a joint production process that produces three products at the split-off point. Joint production costs during April were $720,000. The company uses the net realizable value method for allocating joint costs. Product information for April was as follows:

Required:

a. Assume that all three products are main products and that they can be sold at the split-off point or processed further, whichever is economically beneficial to Simpson. Allocate the joint costs to the three products.

b. Assume that Simpson uses the physical quantities method to allocate the joint costs. How much would be allocated to each of the three products?

Correct Answer:

Verified

a. R: $218,182; S: $370,909; T: $130,909...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Liberty Credit Checks produces two styles

Q22: Net realizable value at the split-off

Q23: In deciding whether to outsource a service

Q24: Which of the following departments is not

Q25: One potential disadvantage of the reciprocal method

Q27: Which of the three service department allocation

Q28: Castro Corporation has one service department and

Q29: The following is a system of

Q30: Because this allocation method recognizes that service

Q31: Delite Confectionary Company produces various types