Essay

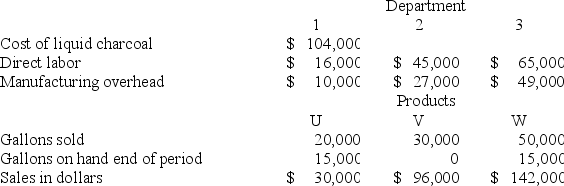

Smokey Enterprises buys Liquid Charcoal for $0.80 a gallon. At the end of processing in Department 1, the liquid charcoal splits off into Products U, V, and W. Product U is sold at the split-off point, with no further processing. Products V and W require further processing before they can be sold; Product V is processed in Department 2, and Product W is processed in Department 3. Following is a summary of costs and other related data for the most recent accounting period:

There were no beginning inventories and there was no liquid charcoal on hand at the end of the period. All gallons on hand in ending inventory were complete as to processing.

Required:

a. Determine the product cost for U, V, and W, assuming the physical quantities method is used to allocate joint costs.

b. Determine the product cost for U, V, and W, assuming the net realizable value method is used to allocate joint costs.

Correct Answer:

Verified

a. U: $35,000; V: $30,000; W: $65,000.

b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: With the reciprocal method, the total service

Q67: Tenet Engineering, Inc. operates two user

Q68: Data Master is a computer software consulting

Q69: For purposes of allocating joint costs to

Q70: Boswell Consulting has two service departments, S1

Q72: The Marketplace Corporation produces two consumer

Q73: The Mallak Company produced three joint

Q74: The following information relates to Osceola

Q75: The Macon Industries started the production of

Q76: Boston Corporation has two production departments, Assembly