Essay

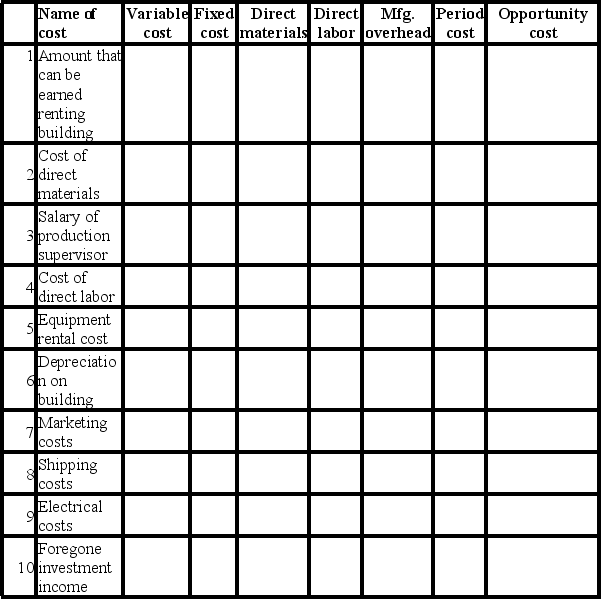

The Torchdown Company began operations several years ago. The company purchased a building, and since only half of the space was needed for operations, the remaining space was rented to another firm for rental revenue of $20,000 per year. The success of Torchdown Company's product has resulted in the company needing more space. The renter's lease will expire next month and Torchdown will not renew the lease in order to use the space to expand operations and meet demand.

The company's product requires direct materials that cost $25 per unit. The company employs a production supervisor whose salary is $2,000 per month. Production line workers are paid $15 per hour to manufacture and assemble the product. The company rents the equipment needed to produce the product at a rental cost of $1,500 per month. Additional equipment will be needed as production is expanded and the monthly rental charge for this equipment will be $900 per month. The building is depreciated on a straight-line basis at $9,000 per year.

The company spends $40,000 per year to market the product. Shipping costs for each unit are $20 per unit. The cost of electricity and other utilities used for product is $2 per unit. The company plans to liquidate several investments in order to expand production. These investments currently earn a return of $8,000 per year.

Required:

Using the table below as a reference, describe which cost headings best identify the costs listed in the first column. As more than one type of cost can be applicable, ensure to list all possibilities when entering your answers (e.g., a cost might be a variable cost, and an overhead cost).

Correct Answer:

Verified

Correct Answer:

Verified

Q84: Shuster Industries manufactures baseballs and identified

Q85: A computer virus destroyed some of the

Q86: The Shoal Company's manufacturing costs for

Q87: The primary goal of the cost accounting

Q88: Hurwitz Corporation had the following activities during

Q90: The following data appeared in Moline

Q91: The information below has been taken

Q92: The following information is available for

Q93: Which one of the following costs is

Q94: Absorption costing measures contribution to operating profit