Essay

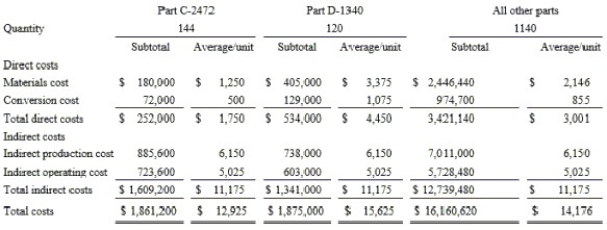

Consider the following cost and production information for Barnard Steel Building Company, Inc.

Additional information:

∙ Sales revenue: $20,000,000.

∙ Beginning inventory: $1,150,000.

∙ Sales of part D-1340: 80 units.

∙ Sales of all other parts are the same as the number of units produced.

∙ Sales price of part D-1340: $35,500 per unit

∙ The only spending increase was for materials cost due to increased production. All other spending as shown above was unchanged.

Barnard Steel Building Company uses the variable costing method.

Required:

(a) Compute the (1) contribution margin, (2) operating income, and (3) ending inventory for Barnard Steel Building Company.

(b) Assume that sales of part D-1340 increase by 30 units to 110 units during the given period (production remains constant). Re-compute the above amounts.

(c) Jaime Porter, the controller of Barnard Steel Building Company, is considering the use of absorption costing instead of variable costing to be in line with financial reporting requirements. She knows that the use of a different costing method will give rise to different incentives. Explain to her how alternative methods of calculating product costs create different incentives.

Correct Answer:

Verified

(a)  Note: Variable cost of goods sold i...

Note: Variable cost of goods sold i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: A number of costs are listed below.<br>

Q33: Ramos Company has the following unit

Q34: The process of assigning indirect costs to

Q35: Explain the difference between a direct cost

Q36: Tulsa Company, (a merchandising co.) has

Q38: Grover Company has the following data

Q39: The following cost and inventory data

Q40: Calculate the conversion costs from the

Q41: The Work-in-Process Inventory of the Model Fabricating

Q42: The cost accountant for the Friendly