Essay

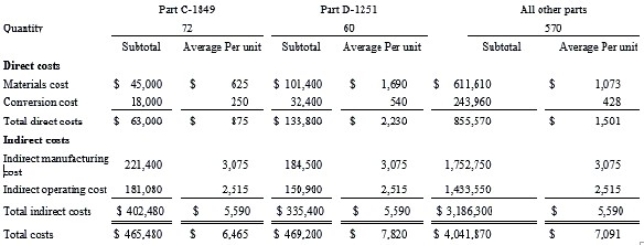

Consider the following cost and production information for Darrell Building Components, Inc.

Additional information:

∙ Sales revenue: $5,200,000.

∙ Beginning inventory: $275,000.

∙ The only spending increase was for materials cost due to increased production. All other spending as shown above was unchanged.

∙ Sales of all parts are the same as the number of units produced.

Darrell Building Components, Inc. uses the absorption costing method.

Required:

(a) Compute the (1) gross margin, (2) operating income, and (3) ending inventory for Darrell Building Components, Inc.

(b) Assume that production of part D-1251 increases by 25 units during the given period (sales remain constant). Re-compute the above amounts.

(c) Thane Smith, the cost manager of Darrell Building Components, argues with the controller that variable costing is a better method for product costing. Using the information in part (b) above, re-compute the operating income for Darrell Building Components using variable costing. Explain any differences in the operating incomes obtained under the two different methods.

Correct Answer:

Verified

(a)  Note: Absorption cost of goods sold...

Note: Absorption cost of goods sold...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Manufacturing overhead:<br>A) can be either a variable

Q45: An example of a period cost is:<br>A)

Q126: The Foxboro Manufacturing Company provided you

Q127: Which of the following statements is (are)

Q128: The Younce Equipment Company provided you

Q131: An expense is a cost charged against

Q132: The information below has been taken

Q133: During the year, a manufacturing company

Q134: The three categories of product costs are

Q135: The beginning Finished Goods Inventory plus the