Multiple Choice

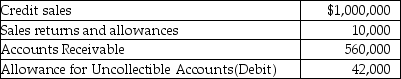

At the end of the year, Smith Company has the following information available:  The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense. In the prior year, uncollectible accounts were estimated at 1% of credit sales. What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense. In the prior year, uncollectible accounts were estimated at 1% of credit sales. What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

A) increase the percentage in the percent-of-sales method

B) reexamine credit policies

C) change to the direct write-off method

D) A and B

Correct Answer:

Verified

Correct Answer:

Verified

Q192: A company that uses the allowance method,

Q193: The percent-of-sales method of computing uncollectible accounts

Q194: A year-end review of Accounts Receivable and

Q195: Investments in debt and equity securities create

Q196: The maturity value of a $53,000 note

Q197: Cash that results from collections on account

Q198: What is the benefit and cost of

Q199: Strategies to increase the current ratio may

Q201: On December 31, 2017, Sandy Company has

Q202: A company will have an unrealized loss