Essay

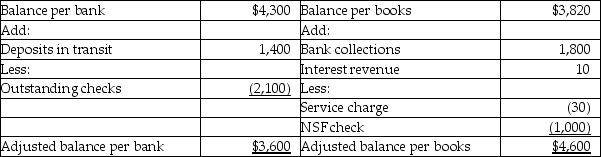

The owner of Samuelson Inc. has reason to believe that an employee has been stealing cash from the company. The employee receives cash from clients, makes the bank deposit, and also prepares the monthly bank reconciliation. To check up on the employee, the owner prepares the following bank reconciliation:

Samuelson Inc.

Bank Reconciliation

September 30

1. Does it appear the employee has stolen from the company? If so, how much? Explain your answer.

1. Does it appear the employee has stolen from the company? If so, how much? Explain your answer.

2. Which side of the bank reconciliation shows the company's TRUE cash balance?

Correct Answer:

Verified

1. Yes, it appears the employee has stol...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: In a bank reconciliation,items recorded by the

Q21: A bank statement included a NSF check

Q74: Another term for a "hot check" is:<br>A)electronic

Q102: Which of the following is a CORRECT

Q110: After approving an invoice for payment:<br>A)the receiving

Q115: Opportunity in the fraud triangle arises from:<br>A)weak

Q135: A check received from a customer for

Q148: Nichols Co. has the following information for

Q150: The type of fraud committed by employees

Q156: When reporting cash on the balance sheet,