Multiple Choice

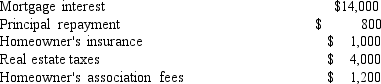

Jackie is in the 28% marginal tax bracket and has no other itemized deductions except those related to her home.If her standard deduction is $4,750 and she incurs the following costs related to housing,how much tax savings will she receive as a result of her home purchase?

A) $13,250

B) $ 5,040

C) $ 3,710

D) $ 2,800

E) none

Correct Answer:

Verified

Correct Answer:

Verified

Q38: If the maximum loan-to-value ratio that a

Q48: Choose the word or phrase in [

Q58: A PITI payment is composed of principal,interest,real

Q72: Automobiles tend to decrease in value over

Q78: To refinance a mortgage,the lender typically requires

Q102: Renting affords more flexibility than home ownership.

Q138: A 5 percent down payment will result

Q151: Homeowner's insurance will cost about _ percent

Q163: An increase in the "rent ratio" indicates

Q196: The affordability ratios used to qualify applicants