Multiple Choice

Table

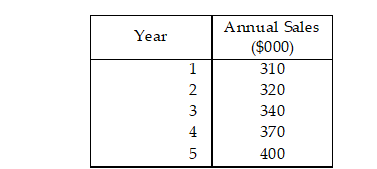

Mr. Lee is considering a capacity expansion for his supermarket. The annual sales projected for the next five years follow. The current capacity is equivalent to sales. Assume a 20 percent pretax profit margin.

-Using the information in Table 5.4, if Lee expands the capacity to an equivalent of $360,000 sales now (year 0) , and then expands the capacity to an equivalent of $400,000 sales at the beginning of year 4, how much would pretax cash flow increase in total for all years (years 1 through 5) ?

A) less than $30,000

B) more than $30,000 but less than $40,000

C) more than $40,000 but less than $50,000

D) more than $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Equipment breakdowns are an example of an

Q36: Mr. Grant is considering a capacity expansion

Q37: The maximum output that a process or

Q38: A company's production facility, consisting of

Q40: Which one of the following statements explaining

Q41: Table <span class="ql-formula" data-value="5.3"><span class="katex"><span

Q42: Explain the distinction between effective capacity and

Q43: Explain the distinction between blocked and starved

Q44: If a system is well balanced, which

Q99: What are the four steps involved in