Multiple Choice

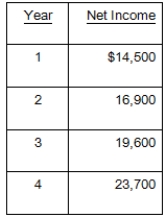

An investment has an initial cost of $300,000 and a life of four years.This investment will be depreciated by $60,000 a year and will generate the net income shown below.Should this project be accepted based on the average accounting rate of return (AAR) if the required rate is 9.5 percent? Why or why not?

A) Yes, because the AAR less than 9.5 percent

B) Yes, because the AAR is 9.5 percent

C) Yes, because the AAR is greater than 9.5 percent

D) No, because the AAR is 9.5 percent

E) No, because the AAR is greater than 9.5 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Diamond Enterprises is considering a project that

Q63: Which one of the following methods of

Q64: A project has the following cash flows.What

Q65: Which one of the following methods of

Q66: You are considering the following two mutually

Q68: The net present value profile illustrates how

Q69: Services United is considering a new project

Q70: An investment has an initial cost of

Q71: Which one of the following analytical methods

Q72: If an investment is producing a return