Multiple Choice

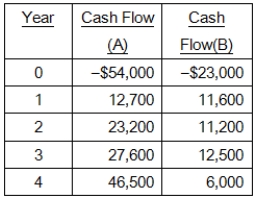

Consider the following two mutually exclusive projects:  Whichever project you choose, if any, you require a rate of return of 14 percent on your investment.If you apply the payback criterion, you will choose Project ______; if you apply the NPV criterion, you will choose Project ______; if you apply the IRR criterion, you will choose Project _____; if you choose the profitability index criterion, you will choose Project ___.Based on your first four answers, which project will you finally choose?

Whichever project you choose, if any, you require a rate of return of 14 percent on your investment.If you apply the payback criterion, you will choose Project ______; if you apply the NPV criterion, you will choose Project ______; if you apply the IRR criterion, you will choose Project _____; if you choose the profitability index criterion, you will choose Project ___.Based on your first four answers, which project will you finally choose?

A) A; B; A; A; B

B) A; A; B; B; A

C) A; A; B; B; B

D) B; A; B; A; A

E) B; A; B; B; A

Correct Answer:

Verified

Correct Answer:

Verified

Q106: What is the net present value of

Q107: An investment has conventional cash flows and

Q108: Which one of the following is true

Q109: The profitability index reflects the value created

Q110: Delta Mu Delta is considering purchasing some

Q111: A project has expected cash inflows, starting

Q112: Which one of the following methods of

Q114: John is considering a project with cash

Q115: You are considering an investment for which

Q116: What is the NPV of the following