Multiple Choice

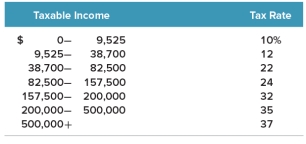

Use the following tax table to answer this question:  Andrews Dried Fruit, LLC has taxable income of $630,000.How much does it owe in taxes?

Andrews Dried Fruit, LLC has taxable income of $630,000.How much does it owe in taxes?

A) $141,750

B) $154,800

C) $198,790

D) $220,500

E) $233,100

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Leslie Printing has net income of $26,310

Q24: Paid-in surplus is classified as:<br>A)owners' equity.<br>B)net working

Q25: A negative cash flow to stockholders indicates

Q26: Lew's Auto Repair has cash of $18,600,

Q27: For the year, Uptowne Furniture had sales

Q29: For the past year, LP Gas, Inc.,

Q30: The tax rate that determines the amount

Q31: Last year, The Pizza Joint added $6,230

Q32: Use the following tax table to

Q33: Marenelle Construction has beginning retained earnings of