Multiple Choice

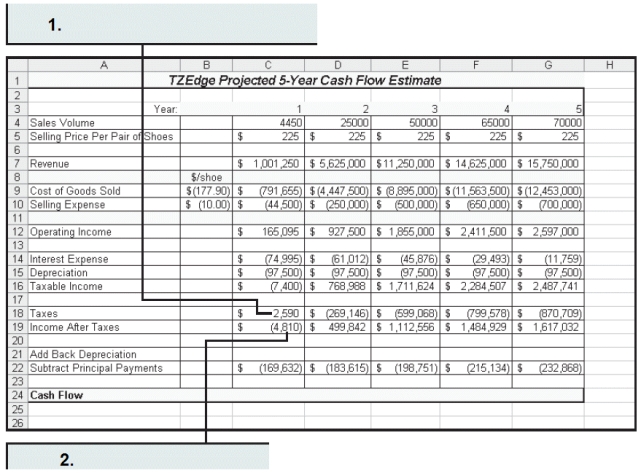

Phil has put together the worksheet above with a 5-year cash flow estimate for his shoe company. He needs to explain the chart to his investors. Please answer the questions below using this figure as a reference.

-Phil also assumes that the actual taxes owed will be rounded to the nearest dollar. Using this information, he enters the formula ____ in cell C18 to calculate the taxes. This is the area indicated by #1 in the figure above.

A) =ROUND(Taxrate*C16,0)

B) =-ROUND(Taxrate*C16,0)

C) =-ROUND(Taxrate*C16,1)

D) =-ROUND(Taxrate*C16,2)

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A bank account would have an fv

Q26: The IPMT function calculates the value of

Q27: The depreciation method with the formula =DB(cost,salvage,life,period,[month])

Q28: Stockholders often look at the _ as

Q29: The _ method calculates the rate at

Q31: The function =-ROUND(Taxrate*C16,0) will round taxes to

Q32: Taxes are calculated based on _ income,

Q33: In projects where cash flows are negative

Q34: The payback period is the time it

Q35: If you are calculating payments to a