Multiple Choice

Note: This is a Kaplan CPA Review Question

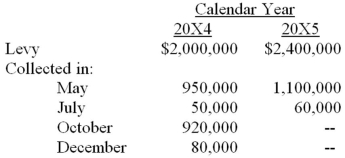

Pine City's year end is June 30. Pine levies property taxes in January of each year for the calendar year. One-half of the levy is due in May and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Pine's property taxes for the period from July 1, 20X4, to June 30, 20X5:

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5. What amount should Pine recognize for property tax revenue for the year ended June 30, 20X5?

A) $2,160,000

B) $2,200,000

C) $2,360,000

D) $2,400,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which combination of fund and measurement basis

Q8: Note: This is a Kaplan CPA Review

Q9: Gotham City acquires $25,000 of inventory on

Q12: Note: This is a Kaplan CPA Review

Q15: Note: This is a Kaplan CPA Review

Q32: Which governmental fund includes resources that are

Q35: In accounting for governmental funds,which of the

Q39: The general fund of Athens ordered computer

Q64: The general fund of Park City acquired

Q73: Which of the following funds should use