Multiple Choice

Note: This is a Kaplan CPA Review Question

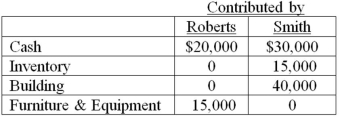

Roberts and Smith drafted a partnership agreement that lists the following assets contributed at the partnership's formation:

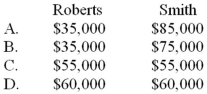

The building is subject to a mortgage of $10,000, which the partnership has assumed. The partnership agreement also specifies that profits and losses are to be distributed evenly. What amounts should be recorded as capital for Roberts and Smith at the formation of the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q9: A limited liability company (LLC):<br>I.is governed by

Q11: Which of the following statements best describes

Q17: When the old partners receive a bonus

Q32: Which of the following statements best describes

Q41: Note: This is a Kaplan CPA Review

Q47: In the AD partnership, Allen's capital is

Q48: A partner's tax basis in a partnership

Q49: The terms of a partnership agreement provide

Q49: In the AD partnership, Allen's capital is