Essay

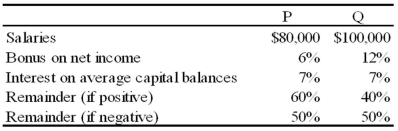

The PQ partnership has the following plan for the distribution of partnership net income (loss):

Required:

Calculate the distribution of partnership net income (loss) for each independent situation below (for each situation, assume the average capital balance of P is $140,000 and of Q is $240,000).

1. Partnership net income is $360,000.

2. Partnership net income is $240,000.

3. Partnership net loss is $40,000.

Correct Answer:

Verified

Situation 1: Net income is $36...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The APB partnership agreement specifies that partnership

Q3: The APB partnership agreement specifies that partnership

Q6: Note: This is a Kaplan CPA Review

Q7: In the ABC partnership (to which Daniel

Q10: In the AD partnership, Allen's capital is

Q18: A joint venture may be organized as

Q36: Griffin and Rhodes formed a partnership on

Q42: When a partnership is formed,noncash assets contributed

Q57: When a new partner is admitted into

Q59: Which of the following observations is true