Multiple Choice

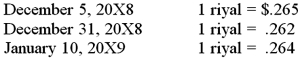

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) , to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:  Based on the preceding information, what journal entry would Imperial make on December 31, 20X8, to revalue foreign currency payable to equivalent U.S. dollar value?

Based on the preceding information, what journal entry would Imperial make on December 31, 20X8, to revalue foreign currency payable to equivalent U.S. dollar value?

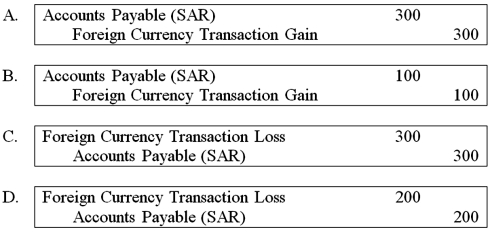

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following observations is true

Q13: Mint Corporation has several transactions with foreign

Q52: All of the following are management tools

Q55: Spartan Company purchased interior decoration material from

Q56: Spiralling crude oil prices prompted AMAR Company

Q57: Note: This is a Kaplan CPA Review

Q58: On December 1, 20X8, Hedge Company entered

Q59: On December 5, 20X8, Texas based Imperial

Q61: On December 1, 20X8, Hedge Company entered

Q62: On December 1, 20X8, Hedge Company entered