Multiple Choice

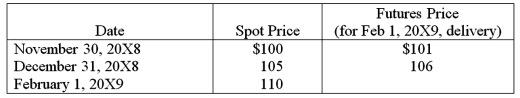

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

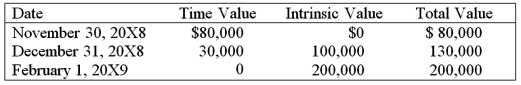

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information, in the entry to record the increase in the intrinsic value of the options on December 31, 20X8,

A) Purchased Call Options will be credited for $100,000.

B) Purchased Call Options will be debited for $130,000.

C) Retained Earnings will be credited for $100,000.

D) Other Comprehensive Income will be credited for $100,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following observations is true

Q13: Mint Corporation has several transactions with foreign

Q45: Note: This is a Kaplan CPA Review

Q46: Chicago based Corporation X has a number

Q47: Spartan Company purchased interior decoration material from

Q48: Suppose the direct foreign exchange rates in

Q49: On December 1, 20X8, Denizen Corporation entered

Q51: The fair market value of a near-month

Q52: All of the following are management tools

Q55: Spartan Company purchased interior decoration material from