Multiple Choice

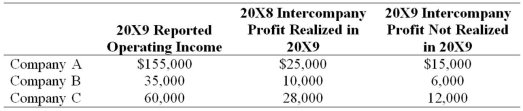

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock. All acquisitions were made at book value. The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies. The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000. Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X9 is as follows:  Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Based on the information provided, what amount of income tax expense should be assigned to Company C?

A) $24,000

B) $35,200

C) $19,200

D) $30,400

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Which of the following observations concerning the

Q27: Tower Corporation's controller has just finished preparing

Q28: Catalyst Corporation acquired 90 percent of Trigger

Q29: On July 1, 20X8, Fair Logic Corporation

Q30: Jupiter Corporation's consolidated cash flow statement for

Q33: New Life Corporation has just finished preparing

Q34: Sigma Company develops and markets organic food

Q35: Company A owns 85 percent of Company

Q36: Catalyst Corporation acquired 90 percent of Trigger

Q37: Power Corporation owns 75 percent of Transmitter