Multiple Choice

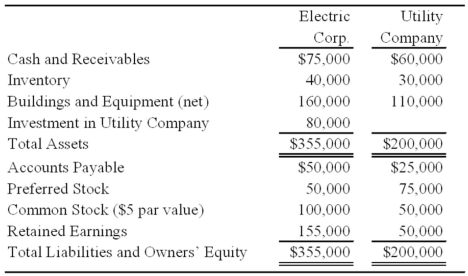

Electric Corporation holds 80 percent of Utility Company's voting common shares, acquired at book values, but none of its preferred shares. At the date of acquisition, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Utility Company. Summary balance sheets for the companies on December 31, 20X8, are as follows:  Neither of the preferred issues is convertible. Electric's preferred pays a 8 percent annual dividend, and Utility's preferred pays a 12 percent dividend. Utility reported net income of $30,000 and paid a total of $10,000 of dividends in 20X8. Electric reported income from its separate operations of $70,000 and paid total dividends of $25,000 in 20X8.

Neither of the preferred issues is convertible. Electric's preferred pays a 8 percent annual dividend, and Utility's preferred pays a 12 percent dividend. Utility reported net income of $30,000 and paid a total of $10,000 of dividends in 20X8. Electric reported income from its separate operations of $70,000 and paid total dividends of $25,000 in 20X8.

Based on the preceding information, what is the amount of earnings available to common shareholders reported in the consolidated financial statements for the year?

A) $89,200

B) $87,000

C) $91,000

D) $82,800

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Locus Corporation acquired 80 percent ownership of

Q9: Company A owns 85 percent of Company

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q10: Catalyst Corporation acquired 90 percent of Trigger

Q11: Jupiter Corporation's consolidated cash flow statement for

Q12: Denver Corporation owns 25 percent of the

Q14: Sigma Company develops and markets organic food

Q15: On December 31, 20X7, Planet Corporation acquired

Q18: Which sections of the cash flow statement

Q56: Winter Corporation's consolidated cash flow statement for